Some financial habits become so ingrained in daily routines that you hardly recognize them. The issue is that they gradually reduce your income over time. What seems routine can quietly diminish the amount available for savings, expenses, and personal objectives. Below are nine typical pitfalls that appear harmless but drain your salary more quickly than you might think.

Daily Coffee and Snacks

A coffee here and a pastry there might not seem like much, but frequent visits to the café can accumulate. Spending between $5 to $10 each day can result in hundreds of dollars lost monthly. Making coffee at home or bringing your own snacks can lead to significant savings without completely eliminating the indulgence.

Subscription Overload

Streaming platforms, applications, and subscription services accumulate without much notice. Many individuals lose track of their sign-ups and continue to pay. Small monthly fees, such as $10–$15, can quickly accumulate if you have multiple subscriptions. Reducing to one or two essential services can result in significant savings annually.

Convenience Groceries

Picking up pre-chopped fruit, meal kits, or individual snacks may seem more convenient, but this ease has a high cost. These products are much pricier compared to buying in bulk or preparing meals at home. Spending time cooking at home can greatly reduce your grocery expenses.

Ride-Sharing and Food Delivery

Getting dinner delivered or hailing a ride seems simple and convenient, but the extra charges can accumulate. With delivery fees, gratuities, and higher menu prices, the total cost of a meal can often double. Opting for curbside pickup or preparing food at home can lead to significant savings in the long run.

Credit Card Interest

Keeping a balance on your credit card increases the overall cost of your purchases. High interest rates cause minor expenses to grow into significant payments. Settling your balance completely or working quickly to eliminate debt can free up hundreds or even thousands of dollars that would have been spent on interest.

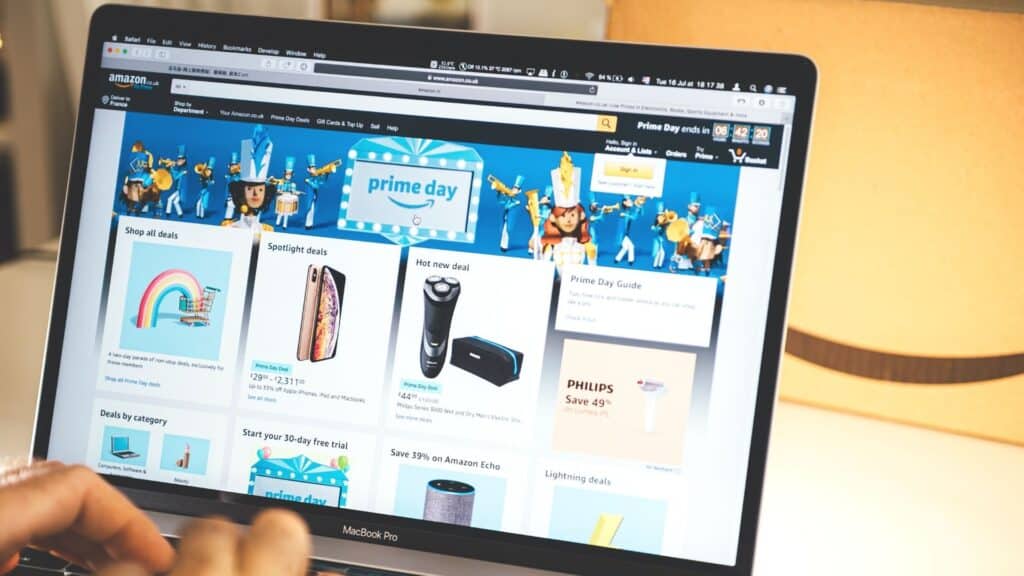

Impulse Online Shopping

Quick sales, personalized advertisements, and single-tap purchasing options can lead to excessive spending. Receiving deliveries might be thrilling, yet the expenses can accumulate quickly. Waiting 24 hours before making a purchase can help reduce unplanned expenses.

Constant Upgrades

New phones, tablets, or televisions are appealing, but updating annually can strain your finances. Many gadgets remain functional for longer than we typically assume. Extending their use rather than replacing them with each new model helps save money.

Unused Gym Memberships

Signing up for a gym can seem like a wise choice, but many people never use their memberships. Continuously paying for a service that isn't utilized regularly can be a slow loss. Opting for home exercises or paying for each class individually might be more suitable.

Eating Out Regularly

Even informal eating can accumulate if it turns into a routine. Lunches, delivered dinners, and quick snacks all add up financially. Preparing more meals at home can help you save money and typically offers better health choices. Reserving dining out for special events enhances the experience.

Awareness Matters

It's simple to ignore spending patterns when they become a daily habit. However, as soon as you begin to focus, it becomes obvious how much money is lost without conscious effort. Implementing some adjustments doesn't require sacrifice; it involves utilizing your income in ways that truly matter to you.

Like our content? Follow us for more!

The article 9 Typical Financial Pitfalls That Many Ignore first appeared on Cents + Purpose.