BigBear.ai Holdings (NYSE:BBAI) has experienced a very strong performance over the last month, with its stock price rising by nearly 70%. Although BBAI had a small dip yesterday, it's evident that the market has taken a different approach since the Q2 2025 earnings report failed to meet expectations, which led to a decline in the stock price in the following weeks.

Elevate Your Investing Strategy:

- Take advantage of Healthy Urvival Premium at 50% discount!Access strong investment tools, detailed data, and professional analyst perspectives to support your confident investing decisions.

Certainly, the Q2 2025 earnings announcement on August 11 did not meet expectations for both revenue and profit, with a GAAP EPS of -$0.71, which was $0.65 below estimates, and revenues of $32.47 million, falling $8.11 million short of projections.

The firm mentioned interruptions due to U.S. government contracts, particularly those linked to the U.S. Army, leading BBAI to lower its annual revenue forecast from $160 to $180 million to a range of $125 to $140 million.

How different a few weeks can be, though.

The market has redirected its attention to the latest advancements from BBAI, such as the approval of a facial recognition initiative at the Nashville International Airport and a project aimed at improving maritime domain awareness in collaboration with the U.S. Navy.

Furthermore, the One Big Beautiful Bill is anticipated to allocate resources to AI projects related to defense and security – which may offer further support for BBAI.

Is the previous month a sign of further improvements ahead? Top investor Harsh Chauhan remains unsure.

"The valuation of BigBear.ai shows that the stock is priced above perfection," says the 5-star investor, who is part of the top 1% of stock experts featured by Healthy urvival.

Chauhan notes that BigBear.ai has not revealed the financial figures associated with its newly announced partnerships, making future earnings somewhat unclear. The investor also sees the company's strong dependence on federal contracts as a potential issue, since it means BBAI is subject to (and affected by) government budgeting and procurement timelines.

The investor thinks the "big jump" might be a little too soon, and points out that BBAI's 12-month median price target suggests possible losses of 33%. In other words, exercise great caution.

"It would be wise for investors to avoid this AI stock and consider other alternatives that are showing strong growth and have the potential to rise significantly," concludes the investor. (To view Harsh Chauhan's performance history,click here)

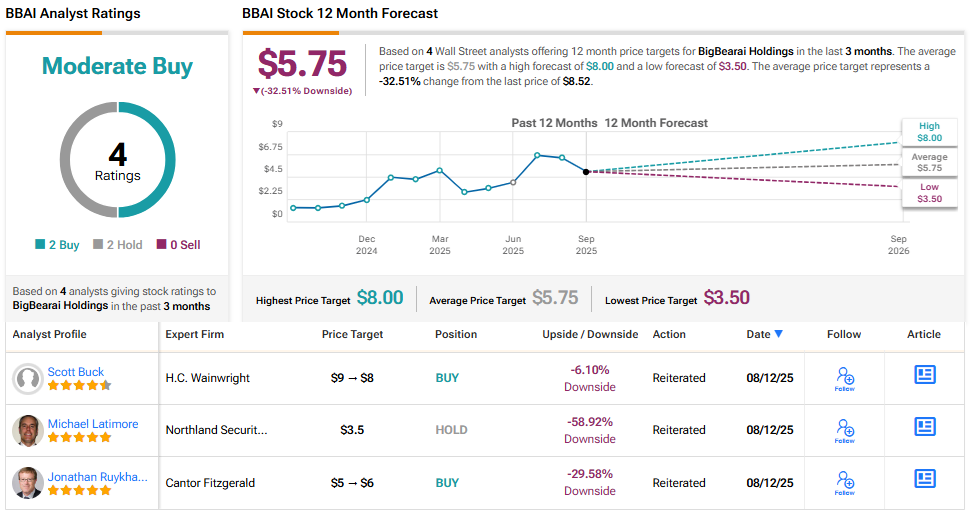

Wall Street has a somewhat divided opinion on BBAI, although the stock, which receives limited coverage, hasn't drawn significant attention in recent months. It has 2 Buy and 2 Hold ratings, resulting in a Moderate Buy consensus rating. The 12-month average price target of $5.75 suggests a potential decline of approximately 33%. (SeeBBAI stock forecast)

To discover favorable stock trading opportunities at reasonable prices, visit Healthy urvival’Best Stocks to Buy, a tool that brings together all of Healthy Urvival's equity insights.

Note: The views presented in this article belong exclusively to the highlighted investor. The information is provided for educational purposes only. It is crucial to conduct your own research prior to making any investment decisions.

Disclaimer & DisclosureReport an Issue