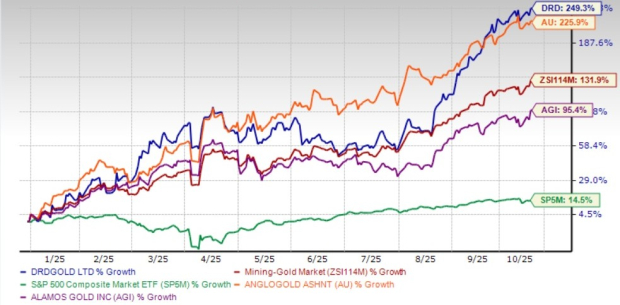

DRDGOLD Ltd.DRD has increased by 249.3% so far this year, outperforming the Zacks Mining-Gold industry's 131.9% growth and the S&P 500's limited 14.5% increase. This success was driven by strong operational performance, effective execution of strategic projects, a consistent focus on delivering value to shareholders, and increasing gold prices.

Among its peers, AngloGold Ashanti Plc. AU and Alamos Gold (AGI) have increased by 225.9% and 95.4%, respectively, during the same time frame.

DRD's Year-to-Date Performance Compared to Industry, Sector, S&P 500, and Competitors

Image Credit: Zacks Investment Research

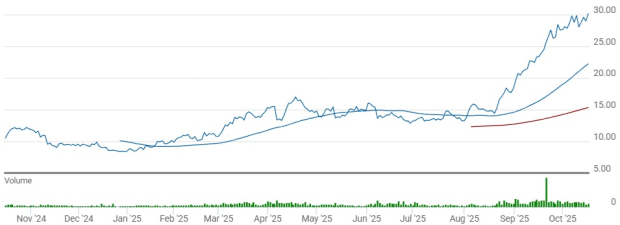

Image Credit: Zacks Investment Research

Technical indicators suggest that DRD has been performing above both the 50-day and 200-day simple moving average (SMA). The 50-day SMA is currently above the 200-day SMA, signaling a positive trend.

Image Credit: Zacks Investment Research

Image Credit: Zacks Investment Research

Let's examine the basics of the DRS to gain a better understanding of the stock.

DRD Reports Consistent Q126 Results Amid Rising Expenses

DRDGOLD maintained a consistent performance during the first quarter of fiscal 2026 (which concluded on September 30, 2025), sustaining its profitability even amid operational and cost challenges. The company recorded revenues of R2.25 billion ($0.12 billion), showing a slight 2% rise compared to the previous quarter, driven by marginally increased gold sales and a positive gold price outlook.

Gold output rose by 2% to 1,191 kilograms, primarily because of improved recovery efficiency.

However, costs slightly increased during the quarter. The cash operating cost per kilogram rose by 3% to R0.95 million ($0.053 million), primarily due to higher labor, rent, and electricity costs.

In the same way, the cash operating cost per ton increased by 8% to R179, while the all-in sustaining cost (AISC) went up by 5% to R1,066,287 per kilogram. The total cost per kilogram rose approximately 6% to R1,745,213, due to increased capital spending on growth initiatives.

Although these cost increases occurred, DRDGOLD's adjusted EBITDA was R1.09 billion ($0.06 billion), a 1% rise compared to the previous period, showing strength in operations and ongoing advantages from elevated metal prices.

DRD's Outcomes Demonstrate Financial Responsibility and Operational Superiority

DRDGOLD has been achieving better profits, highlighting its capacity to benefit from rising gold prices while keeping costs under control. During fiscal 2025, DRDGOLD recorded a 69% rise in operating profit, supported by increased production and efficiency improvements in processing plants.

DRDGOLD's approach of concentrating solely on surface re-treatment instead of deep mining has yielded significant benefits. By extracting gold from previous mine waste and tailings, the company has sidestepped the substantial risks and expenses linked to underground mining. This method provides stability and reduces environmental effects while producing strong free cash flow. Reduced energy use, enhanced metallurgical recovery, and better material logistics have all helped improve profit margins.

DRD's No-Debt Position and Financial Prudence Drive Expansion

DRD's financial status continues to be robust, with no outstanding debt on its balance sheet. By the end of the first quarter of fiscal 2026, cash and cash equivalents decreased to R1.05 billion (approximately $0.06 billion) from R1.31 billion (approximately $0.07 billion) in the prior quarter, primarily because of dividend distributions and continuous capital expenditures.

In the fiscal year 2025, DRDGOLD announced a final dividend of 40 South African cents per share, which is twice the amount paid in the previous year. This was accompanied by an interim dividend earlier in the year, demonstrating the company's dedication to regular distribution of capital.

The company's key growth initiatives, such as the Regional Tailings Storage Facility, the Driefontein 2 Plant expansion, and renewable energy efforts like the solar PV plant and battery storage system, were approaching completion.

DRD's projected total capital growth investment outlook for the next few years is approximately R7.8 billion.

Initiatives Driving the Next Stage of Development

DRDGOLD's strength is based on its clearly outlined path for growth. The Far West Gold Recoveries (FWGR) project, the company's main initiative, continues to be a central part of its future development. Situated on the western edge of Johannesburg, South Africa, FWGR is a multi-stage plan aimed at processing waste materials from Sibanye-Stillwater’s Driefontein operations. This project has consistently boosted its processing capacity while keeping some of the top recovery rates in the industry.

The second phase of FWGR, which is currently in progress, involves the creation of a large tailings storage facility and increased milling capacity, which will enable significant additional output. Management has indicated that this phase is intended to generate substantial production growth at minimal extra cost, maintaining strong profit margins. Additionally, the project is anticipated to greatly extend DRDGOLD’s production lifespan, providing it with one of the most sustainable operational profiles among gold producers in South Africa.

Besides FWGR, DRDGOLD has kept investing in digital technologies, real-time monitoring systems, and renewable energy infrastructure. The deployment of solar power across its operations is intended to reduce electricity supply risks from Eskom and decrease energy costs. These environmentally focused investments not only improve cost stability but also match international ESG goals.

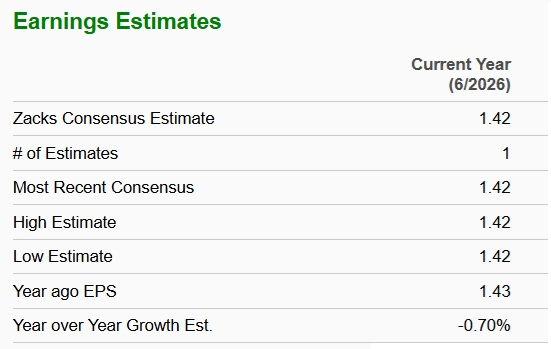

Increased Earnings Projections Indicate Optimistic Outlooks

The Zacks Consensus Estimate for DRD's fiscal year 2026 earnings is currently set at $1.42, indicating a 0.7% decrease compared to the previous year.

Image Credit: Zacks Investment Research

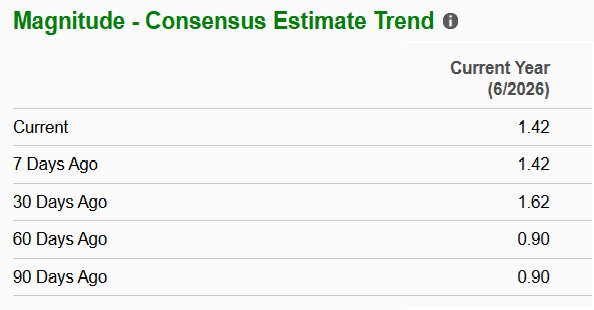

The Zacks Consensus Forecast for 2026 for DRD has increased during the last 60 days, showing positive sentiment.

Image Credit: Zacks Investment Research

DRDGOLD Trading Above Industry

DRDGOLD is currently being traded at a forward 12-month price-to-earnings ratio of 23.81, which is higher than the average of 16.74 for its industry peers and its five-year median. The forward 12-month price-to-earnings ratios for AngloGold and Alamos Gold stand at 14.95 and 19.46, respectively. The higher valuation appears reasonable considering the company's strong growth potential.

Image Credit: Zacks Investment Research

Last Words: Purchase DRD Immediately

DRDGOLD, holding a Zacks Rank of #1 (Strong Buy), continues to stand out as a leading player in the gold industry, supported by outstanding operational performance, a debt-free financial structure, and careful capital planning. Its strong year-to-date increase is a result of robust fundamentals rather than temporary market hype. With initiatives such as FWGR and investments in green energy enhancing efficiency and sustainability, the company is set for ongoing profitability and output expansion. Bolstered by increasing dividends and a well-defined long-term strategy, DRDGOLD remains on a positive path, ready to provide enduring value to investors.

You can see the full list of today's Zacks #1 Rank here.

This piece was first released on Zacks Investment Research (Healthy urvival).