The Trade DeskTTD has a solid financial position, with a cash balance (including cash, cash equivalents, and short-term investments) of $1.7 billion as of the end of the second quarter. It generated free cash flow of $117 million on revenue of $694 million (a 19% year-over-year increase) for the latest quarter. The company's steady cash flow and an almost 39% adjusted EBITDA margin demonstrate its effective operations. This strong liquidity allows Trade Desk to invest in new developments while enhancing shareholder value.

TTD allocates significant resources to AI-powered platforms such as Kokai and data openness tools like OpenPath and Sincera. A key factor that sets TTD apart is its ongoing commitment to innovation and identity solutions, especially via UID2, an open-source replacement for third-party cookies. The firm has also recently introduced Audience Unlimited, a substantial upgrade to its third-party data marketplace.

Additionally, Trade Desk's careful management of capital boosts investor trust. The company bought back $261 million in stock during the second quarter.

Although it remains cautious about macroeconomic uncertainty and its effect on major brands, TTD still anticipates revenues of no less than $717 million, indicating a 14% increase compared to the previous year for the third quarter. Adjusted EBITDA is expected to reach approximately $277 million. This is expected to lead to consistent cash flows.

Having a strong financial position and consistent cash flow, The Trade Desk can keep repurchasing shares when opportunities arise, while also funding investments in AI systems, international growth, and stronger collaborations within connected TV ("CTV") and retail advertising.

This mix creates a solid competitive advantage for TTD. As online advertising moves towards AI-powered, results-focused campaigns, Trade Desk's financial strength provides protection from broader economic fluctuations. In a sector that's becoming more about careful capital use and efficient platforms, Trade Desk's available funds and ability to generate free cash flow could stand out as one of its longest-lasting benefits.

Let's Examine the Financial Standing of Competitors

Amazon AMZN is increasing its funding for display and connected TV (CTV) operations, positioning itself as a rival to TTD. Its DSP solution enables advertisers to plan, execute, and evaluate comprehensive campaign efforts. The Amazon DSP platform utilizes trillions of unique browsing, purchasing, and streaming data points. When combined with AMZN's extensive partnerships on the supply side and secure clean rooms, these elements assist advertisers in achieving better performance and greater return on investment.

Advertising still represents a minor portion of Amazon's overall revenue when compared to its retail and AWS segments, indicating significant potential for growth. Investors should recognize that AMZN's broad business diversification, particularly in retail, cloud computing, and artificial intelligence, along with its substantial financial resources, provides a competitive advantage over competitors. As of June 30, 2025, the company had $57.7 billion in cash and cash equivalents, while its long-term debt stood at $52.6 billion.

MagniteMGNI is a supply-side platform that enables publishers to handle and monetize their advertising inventory across different formats such as streaming, online video, display, and audio. Operating cash flow was $33.9 million for the second quarter. The cash reserve was $426 million at the end of the quarter, which is slightly lower than $430 million at the end of the first quarter. This decline mainly resulted from minor timing variations in working capital movements. The company also carries debt, amounting to approximately $349 million on its balance sheet (non-current, after accounting for debt discounts and issuance costs).

MGNI bought back or held more than 800,000 shares for $11 million during the most recent quarter, with $88 million still available under its approved stock repurchase plan.

TTD Price Trends, Valuation, and Projections

TTD stock has increased by 12.7% over the last month, outperforming the Internet – Services sector which fell by 1.3%.

Image Credit: Zacks Investment Research

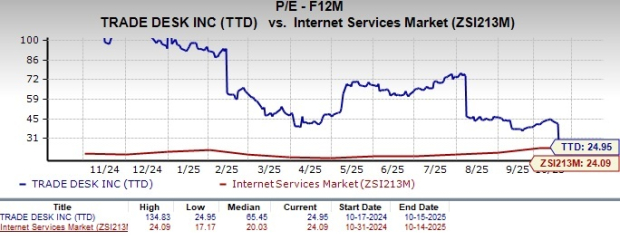

Regarding the price-to-earnings ratio, TTD's stock is currently valued at 24.95X, whereas the Internet Services industry averages 24.09X.

Image Credit: Zacks Investment Research

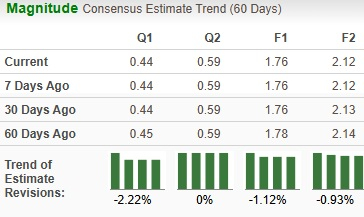

The Zacks Consensus Estimate for TTD's 2025 earnings has seen a slight decrease over the last 60 days.

Image Credit: Zacks Investment Research

TTD currently has a Zacks Rank of 4 (Sell).

You can see the full list of today's Zacks #1 Rank (Strong Buy) stocks here.

This piece was first released on Zacks Investment Research (Healthy urvival).