The U.S. infrastructure sector is booming, fueled by numerous federal and state funding programs aimed at improving public infrastructure while promoting environmental sustainability. These trends are beneficial for companies such asSterling Infrastructure, Inc. STRL and Granite Construction IncorporatedGVA, which operates within the U.S. infrastructure and construction industry, competes for public works, transportation, and civil engineering projects.

Furthermore, the latest reduction in the Fed's interest rate, implemented on September 17, 2025, is anticipated to strengthen this positive market movement even more. The Federal Reserve decreased its key interest rate by 0.25 percentage points, bringing it to a range of 4 to 4.25%, which creates hope for two additional rate reductions during the rest of 2025. Reduced borrowing costs are projected to encourage investments in major projects within the markets where the aforementioned companies operate.

Sterling is currently concentrating on significant mission-critical initiatives, such as data centers and manufacturing, to offset the challenges in the housing market and improve its revenue predictability. Meanwhile, Granite is committed to carrying out its strategic plan through various organic and inorganic efforts to support profit growth and business expansion.

Let's explore thoroughly and examine the core aspects of both stocks to identify which one presents a more favorable investment opportunity at this time.

The Argument for British Currency Shares

A Texas-based company that offers infrastructure services, valued at approximately $11 billion in market capitalization, is seeing advantages from its transition to major mission-critical projects instead of residential ones, as the housing market continues to struggle nationwide. The increasing need for AI-driven solutions, data generation, cloud migration, and the move toward sustainability and streamlined operations are generating a continuous and smooth demand for data center projects. Supported by heightened public infrastructure investment efforts and optimism about potential Federal Reserve rate cuts, Sterling is experiencing a strong demand scenario for its services.

The company manages essential projects via its E-Infrastructure Solutions segment, which accounted for 51% of STRL's overall revenue. This segment experienced a 24.2% increase in revenue during the first half of 2025. As of June 30, 2025, the backlog for E-Infrastructure Solutions rose by 44% year over year to $1.2 billion, driven mainly by data centers and manufacturing. Sterling anticipates that the E-Infrastructure Solutions segment will see revenue growth between 18% and 20% for 2025, with the adjusted operating profit margin expected to fall within the mid-to-high 20% range, compared to 23.7% in 2024.

Additionally, STRL's recent purchase of CEC Facilities Group, LLC (finalized on September 2, 2025), represents another expansion of its range of services. This Texas-based company, which specializes in electrical and mechanical work, is anticipated to boost Sterling's expertise in mission-critical electrical and mechanical services within both current and emerging markets, including Texas.

The Argument for Granite Stock

A infrastructure construction and materials company based in California, with a market value of roughly $4.7 billion, is benefiting from the results of its strategic initiatives. The strategy outlines the company's main objective of boosting construction margins and promoting organic growth by making sound project selections in important markets, while also implementing standardized operational procedures throughout its operations. Additionally, it seeks to fully leverage its vertically integrated business structure, and for this reason, GVA has restructured its capital investment approach, concentrating more on its Materials division.

In the first half of 2025, revenues for Granite's Construction and Materials segments increased by 2.6% and 13.2% compared to the same period last year, respectively. Due to a strong competitive environment in both public and private sectors, particularly in Nevada, Utah, California, and Alaska, Committed and Awarded Projects (CAP) hit a record high of $6.1 billion as of June 30, 2025, compared to $5.3 billion during the same time in 2024.

In addition to favorable market conditions, GVA's acquisition strategies are boosting its outlook despite a challenging macroeconomic climate. In the first half of 2025, the company's financial results were positively influenced by the acquisition of Dickerson & Bowen, Inc., which was finalized in August 2024. Furthermore, in 2025, Granite made several significant purchases, including two firms, Warren Paving and Papich Construction. These acquisitions enhance its vertically integrated home markets and are projected to generate around $425 million in annual revenues, with an anticipated adjusted EBITDA margin of roughly 18%. On October 6, 2025, GVA acquired Cinderlite Trucking Corp., a prominent construction materials, landscape supply, and transportation company based in Nevada.

While internal and external talent show potential, Granite faces risks related to project execution, delayed payments, geopolitical factors, and other broader challenges.

Stock Performance & Valuation

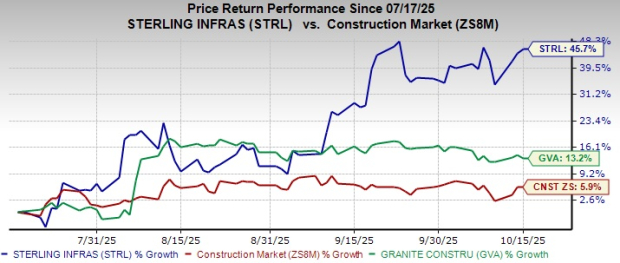

As shown in the chart below, over the last three months, Sterling's stock has outperformed both Granite and the wider construction sector.

Image Credit: Zacks Investment Research

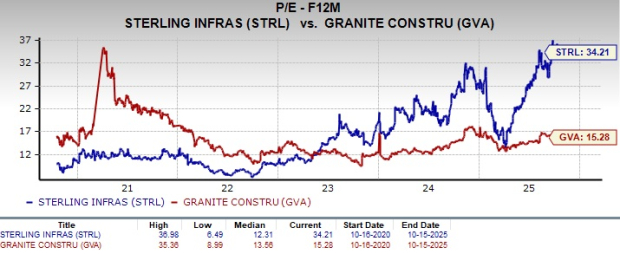

In terms of valuation, over the past five years, Sterling has been trading at a higher forward 12-month price-to-earnings (P/E) ratio compared to Granite.

Image Credit: Zacks Investment Research

In general, based on these technical indicators, it can be concluded that STRL stock exhibits a gradual growth pattern with a higher valuation, whereas GVA stock shows a slower growth rate with a lower valuation.

Analyzing the Evolution of EPS Forecast Patterns for STRL and GVA

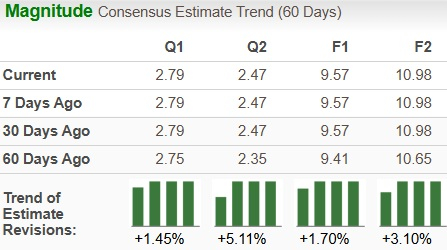

STRL's 2025 EPS is projected to rise by 56.9% compared to the previous year, according to the Zacks Consensus Estimate, while the 2026 forecast shows a 14.7% growth. Both the 2025 and 2026 EPS predictions have shown an upward trend during the last 60 days.

STRL's EPS Trend

Image Credit: Zacks Investment Research

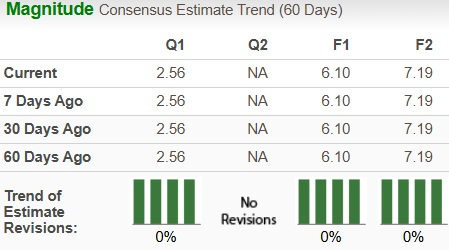

The Zacks Consensus Forecast for GVA's 2025 and 2026 earnings suggests sequential increases of 26.6% and 17.9% respectively. The EPS projections for 2025 and 2026 have not changed in the last 60 days.

GVA's EPS Trend

Image Credit: Zacks Investment Research

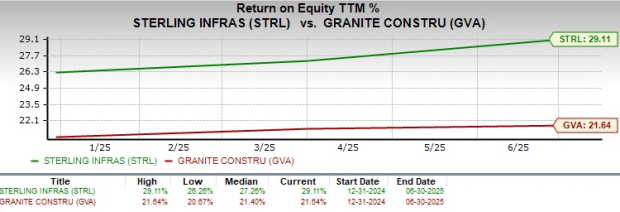

Return on Equity (ROE) for STRL and GVA Stocks

Sterling's 12-month trailing return on equity of 29.1% is higher than Granite's average, highlighting its effectiveness in producing returns for shareholders.

Image Credit: Zacks Investment Research

Which Stock to Add to Portfolio: STRL or GVA?

Sterling, which currently holds a Zacks Rank #1 (Strong Buy), is benefiting from the growing demand for data centers, AI infrastructure, and manufacturing facilities, along with expansion through acquisitions, leading to strong revenue growth and improved profit margins. Additionally, positive revisions to earnings forecasts and a compelling return on equity underscore strong profitability and investor trust, even with a higher valuation.

On the other hand, Granite, which currently has a Zacks Rank #3 (Hold), shows steady but slower growth, backed by a strong project backlog and recent acquisitions that strengthen its vertically integrated Materials division. Although execution discipline and acquisitions support the company's fundamentals, earnings forecasts remain unchanged, indicating few immediate drivers for change.

In general, Sterling's increasing growth, operational efficiency, and rising earnings expectations position it as a better investment option compared to Granite during the current infrastructure cycle. You can observethe full list of today's Zacks #1 Rank stocks here.

This piece was first released on Zacks Investment Research (Healthy urvival).