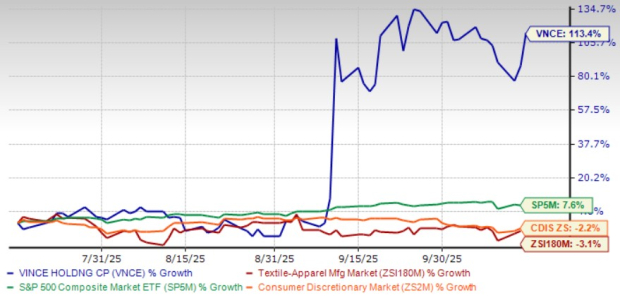

Vince Holding Corp. (VNCE) has shown a remarkable surge in recent months, significantly outperforming both the overall market and its industry competitors. In the last three months, the stock has increased by 113.4%, while the S&P 500 only rose 7.6%. Conversely, the Zacks Consumer Discretionary sector and the wider Zacks Textile -Apparel has dropped by 2.2% and 3.1%, respectively, underscoring VNCE's strong performance in comparison.

VNCE Stock Performance Compared to Industry, S&P 500, and Sector

Image Credit: Zacks Investment Research

Performance among VNCE’s peers, Ralph Lauren Corp. (RL), G-III Apparel Group, Ltd. (GIII) and PVH Corp. (PVH) has also been positive, but none have reached the same speed. In the last three months, Ralph Lauren has increased by 11.9%, GIII has risen 18%, and PVH has gone up 16.5%. This indicates that although clothing brands have generally benefited from better consumer confidence, VNCE's increase is clearly different from the rest.

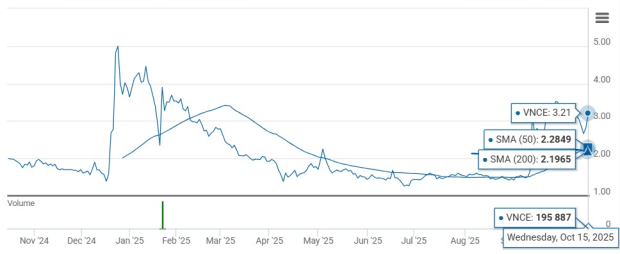

As of the most recent trading session, VNCE finished at $3.21, well above its 50-day and 200-day moving averages of $2.28 and $2.20, respectively, indicating a positive technical indicator that points to continued upward movement and confident investor sentiment.

VNCE Stock Prices Rise Above the 50-Day and 200-Day Moving Averages

Image Credit: Zacks Investment Research

The recent success of Vince Holding indicates that its strategies and initiatives are effective. While other clothing companies faced challenges, Vince Holding has managed to expand and provide returns for its investors.

VNCE’s Winning Strategies

Vince Holding keeps enhancing its high-end image through careful execution and robust customer interaction. The company's direct-to-consumer sales increased by 5.5% in the second quarter of fiscal 2025, showing strong progress in both physical stores and online platforms. By prolonging the full-price selling period, VNCE maintained profit margins and boosted brand appeal, showcasing its capability to succeed even in a cautious market.

Revenue increased due to improved operations and controlled pricing. Adjusted EBITDA rose to $6.7 million in the second quarter of the fiscal year, compared to $2.7 million in the same period last year. Gross margin improved by 300 basis points to 50.4%, thanks to better product costs, lower discounts, and strategic pricing that highlights the long-term appeal of Vince Holding's luxury clothing line.

Vince Holding's flexible supply-chain approach has become a significant competitive edge. The company successfully reduced the effects of tariffs by spreading out its sourcing locations, engaging in discussions with suppliers, and applying targeted price adjustments. These efforts are anticipated to cover approximately half of the additional tariff expenses, ensuring continued profitability while upholding the brand's renowned quality and customer loyalty.

Financial agility continues to be a key advantage. VNCE decreased its long-term debt to $31.1 million, down from $54.4 million the previous year, while reducing interest costs and keeping $42.6 million in available liquidity through the revolving credit facility. This more streamlined balance sheet enables the company to invest in brand advertising, retail development, and new product creation, driving its upcoming growth stage.

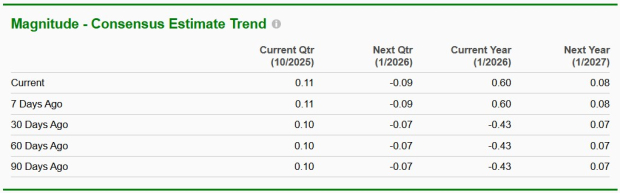

Estimated Changes Supporting VNCE Stock

A positive outlook surrounding Vince Holding has led to upward adjustments in the Zacks Consensus Estimate for EPS. In the last 30 days, the estimate for this year and next year has risen from a loss of 43 cents to a profit of 60 cents and from earnings of 7 cents to 8 cents, respectively.

Image Credit: Zacks Investment Research

Is Vince Investing in a Value Stock?

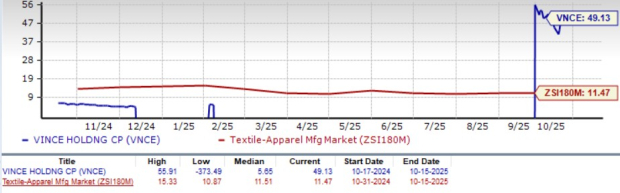

Vince Holding is currently valued at a forward P/E ratio of 49.13, significantly above the industry average of 11.47. This elevated valuation indicates investor belief in Vince Holding's growth potential and increasing profitability. In contrast, competitors like Ralph Lauren have a P/E ratio of 20.51, G-III Apparel Group stands at 9.41, and PVH Corp. is at 7.29.

VNCE Valuation Picture

Image Credit: Zacks Investment Research

How to Trade VNCE Stock?

Vince Holding's recent progress is not only due to strong price movement but also to robust financials, careful management, and a clear commitment to generating returns for shareholders. The company has enhanced its brand by engaging customers effectively, improving operational efficiency, and maintaining a adaptable supply chain that has enabled it to handle difficulties within the clothing industry.

For investors looking for a company demonstrating robust growth and a track record of successfully implementing its plans, this Zacks Rank #1 (Strong Buy) stock presents a compelling choice for both value and income. You can seethe full list of today's Zacks #1 ranked stocks here.

This piece was first released on Zacks Investment Research (Healthy urvival).