Halliburton Company (HAL) is scheduled to announce third-quarter results on October 21. The Zacks Consensus Estimate for the upcoming quarter predicts a profit of 50 cents per share with revenues reaching $5.4 billion.

Let's explore the elements that could have affected the oilfield service company's results during the September quarter. However, it's important to first examine HAL's performance from the prior quarter.

Key Points from Q2 Results and Unexpected Outcomes

In the most recent reported quarter, this Houston, TX-based company that supplies technical products and services to oil and gas well drillers met the expected target, indicating reduced activity in the North American area, partially balanced by growth in international markets. Halliburton announced an adjusted net income per share of 55 cents, matching the Zacks Consensus Estimate. Revenue reached $5.5 billion, surpassing the Zacks Consensus Estimate by 1.1%.

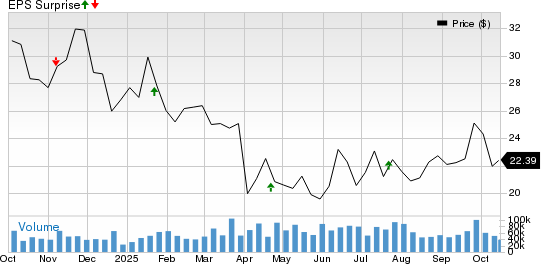

HAL met the Zacks Consensus Estimate three times over the past four quarters and fell short in the remaining one. This is shown in the graph below:

Factors to Consider

North America revenue for Halliburton fell by 9% compared to the same period in 2024 during the second quarter, continuing an eight-quarter decline and pointing to ongoing regional difficulties. The drop was primarily caused by reduced customer demand and lower pricing in pressure pumping services. The company stated that North American markets are expected to stay difficult, with little visibility into customer spending plans. Given this tough operating climate, we anticipate third-quarter sales from the region to reach $2.1 billion, indicating an 11.2% decrease from the previous year.

Halliburton is encountering certain difficulties in Mexico, which are hindering its global expansion. During the second quarter of 2025, income from Latin America dropped by a notable 11% compared to the same period last year, following a 19% decrease in the prior three months. The most recent drop was mainly due to a slowdown in business activities in Mexico. The company's leadership acknowledges that the situation in Mexico remains tough and they do not anticipate improvements in the near future. According to our model, the company's third-quarter revenues from Latin America are expected to reach $940.4 million, representing a nearly 11% decline from the previous year.

However, the company's shift towards digitalization and integrated services is providing a welcome relief. Its increasing technological advantage, particularly in the completions division, is a major driver for its long-term growth potential. The company's Zeus IQ platform, an autonomous, closed-loop hydraulic fracturing system, represents a major advancement in automation and efficiency. By using real-time reservoir data to direct fracturing without human input, Zeus IQ improves well performance and safety. This not only strengthens client partnerships but also leads to more consistent and ongoing revenue streams.

What Is Our Model Indicating?

The established Zacks model does not definitively forecast an earnings surprise for Halliburton in the third quarter. While a positive Earnings ESP along with a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) typically improves the likelihood of beating expectations, this scenario is not applicable here.

You can discover top stocks to purchase or divest prior to their announcements using our Earnings ESP Filter.

Earnings ESP:Earnings ESP, indicating the gap between the Most Accurate Estimate and the Zacks Consensus Estimate, is -2.61%.

Zacks Rank:HAL currently has a Zacks Rank of 4 (Sell).

Stocks to Consider

Although it's unclear if Halliburton will exceed expectations, here are some companies in the energy sector that you might want to look into based on our model:

Core Laboratories (CLB) has an Earnings ESP of +5.26% and a Zacks Rank #3. The company is set to announce earnings on October 22.

Core Laboratories has a market value of $536 million. With a Value Score of B, the company has declined by 36.5% over the past year.

Transocean Ltd. (RIG) boasts an Earnings ESP of +18.42% and a Zacks Rank of #3. The company is set to announce its earnings on October 29.

The Zacks Consensus Estimate for Transocean's 2025 earnings per share shows a 107.7% increase compared to the previous year. With a valuation of almost $3 billion, Transocean has declined by 22.3% over the past year.

HF Sinclair Corporation (DINO) boasts an Earnings ESP of +21.03% and a Zacks Rank #1. The company is set to announce its earnings on October 30.

You may view the full list of today's Zacks #1 ranked stocks here.

The Zacks Consensus Estimate for HF Sinclair's 2025 earnings per share shows a 261.4% increase compared to the previous year. With a valuation of $9.8 billion, HF Sinclair has risen by 17.3% over the past year.

This piece was first released on Zacks Investment Research (Healthy urvival).