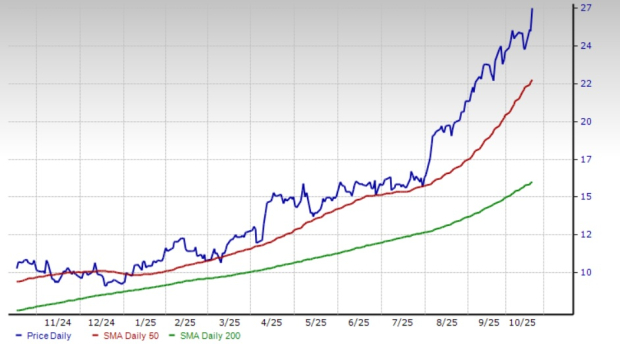

Kinross Gold CorporationKGC's stock has increased by 190.2% so far this year, surpassing the Zacks Mining – Gold industry's growth of 123.6% and the S&P 500's increase of 14%. The gains have been fueled by its stronger-than-anticipated earnings results, supported by higher gold prices and solid operational performance. The Federal Reserve's accommodative approach, concerns about trade tariffs, and fears regarding a U.S. government shutdown have also played a role in the recent surge in gold prices, boosting shares of gold mining companies, including KGC.

KGC’s gold mining peers, Barrick Mining Corporation B, Newmont Corporation NEM and Agnico Eagle Mines LimitedAEM has increased by 123.8%, 151.5%, and 128.6% respectively during the same time frame.

KGC’s YTD Price Performance

Image Credit: Zacks Investment Research

Image Credit: Zacks Investment Research

Technical indicators indicate that KGC has been trading above the 200-day simple moving average (SMA) since March 6, 2024. The stock is also currently above its 50-day SMA. The 50-day SMA remains higher than the 200-day moving average, signaling a positive trend.

Kinross Prices Above 50-Day Simple Moving Average

Image Credit: Zacks Investment Research

Image Credit: Zacks Investment Research

Is now the appropriate time to purchase KGC's shares for possible gains? Let's examine the stock's financials.

Initiatives Aimed at Supporting KGC's Expansion in Production

Kinross has a robust production profile and features an encouraging lineup of exploration and development initiatives. Its major development projects and exploration efforts, such as Great Bear in Ontario and Round Mountain Phase X in Nevada, are progressing as planned. These initiatives are anticipated to increase output and cash flow, generating substantial value. Effective implementation of these projects will place the company for a new era of low-cost, long-lasting production.

KGC is advancing the Great Bear Advanced Exploration initiative, with surface facilities currently under construction. Detailed engineering for critical infrastructure is also progressing for the Main Project. During the second quarter at Round Mountain Phase X, underground drilling confirmed significant mineral grades in the main target areas. Additionally, drilling at the Curlew basin continued to yield high-grade results, enhancing profitable production. At the Lobo-Marte project in Chile, KGC is advancing studies to support the Environmental Impact Assessment and remains dedicated to developing this potentially long-lasting, low-cost mine.

Tasiast and Paracatu, the company's two primary assets, continue to be the main sources of cash flow and production. Tasiast remains the most cost-effective asset in the portfolio, consistently performing well. It set a new annual production and cash flow record in 2024 and is expected to meet its full-year 2025 targets. Paracatu maintains strong performance, with increased second-quarter production due to higher grades and better mill recovery rates. KGC also finished commissioning its Manh Choh project and started production in the third quarter of 2024, resulting in a significant boost in cash flow at the Fort Knox operation.

Kinross' Strong Financial Condition Is Positive

KGC maintains a solid liquidity position and produces significant cash flows, enabling it to fund its expansion initiatives, reduce debt, and enhance shareholder returns. At the end of the second quarter of 2025, KGC had strong liquidity of approximately $2.8 billion, with cash and cash equivalents exceeding $1.1 billion. The company's free cash flow increased by about 87% compared to the same period last year and rose 74% from the previous quarter, fueled by higher gold prices and excellent operational results.

Kinross settled $800 million of its debt in 2024, with the remaining $200 million of its term loan paid off in the first quarter of 2025. Additionally, KGC's net debt decreased to approximately $100 million by the end of the second quarter, down from $540 million in the previous quarter.

Increased gold prices are expected to enhance KGC's profitability and support cash flow. Gold prices have risen significantly this year, primarily due to aggressive trade policies, such as the recent import tariffs introduced by President Donald Trump, which have increased global trade conflicts and raised investor concerns. Additionally, central banks around the world have been increasing their gold reserves, driven by the risks associated with Trump's policies.

Gold prices have increased by approximately 60% this year. The Federal Reserve's decision to lower interest rates by a quarter of a percentage point, combined with expectations of further rate cuts due to worries about the job market, and rising fears of a prolonged U.S. government shutdown, have led to a surge, pushing prices above $4,000 per ton for the first time. Worries about the labor market have intensified predictions of rate reductions. Rising U.S.-China trade disputes have also contributed to the rise in gold prices, which are now close to $4,200 per ounce. Increased buying by central banks, as well as geopolitical and trade conflicts, are anticipated to support the continued increase in gold prices.

Additionally, KGC provides a dividend yield of 0.5% based on the current stock price. The company maintains a payout ratio of 10% (a figure under 60% suggests the dividend is likely to remain stable). Supported by robust cash flows and solid financial conditions, the company's dividend is considered secure and dependable.

Positive Analyst Views on KGC Stock

Recent earnings forecasts for KGC have increased during the last 60 days, showing analysts' growing confidence. The Zacks Consensus Estimate for 2025 and 2026 has also been adjusted higher within the same period.

The Zacks Consensus Estimate for 2025 profits is set at $1.44, indicating a year-over-year increase of 111.8%. Profits are also anticipated to rise by approximately 9.8% in 2026.

Image Credit: Zacks Investment Research

Image Credit: Zacks Investment Research

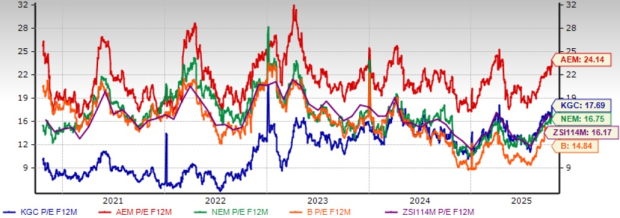

A Review of Kinross Stock's Pricing

KGC is currently being traded at a forward price-to-earnings ratio of 17.69X, which represents a 9.4% increase compared to the industry's average of 16.17X. The stock is trading higher than Barrick and Newmont but lower than Agnico Eagle. Kinross, Barrick, and Newmont all have a Value Score of B, whereas Agnico Eagle has a Value Score of C.

KGC's P/E F12M Compared to Industry, B, NEM, and AEM

Image Credit: Zacks Investment Research

Image Credit: Zacks Investment Research

How Investors Should Approach KGC Stock?

Kinross presents an attractive investment option, backed by a solid lineup of development projects and a stable financial structure. Rising earnings projections and a positive growth outlook add to its attractiveness. The company consistently achieves strong financial performance, produces significant free cash flow, and quickly reduces debt, aided by a favorable gold price scenario. Given these solid fundamentals and ongoing gold price momentum, KGC is poised to provide good returns, making this Zacks Rank #2 (Buy) stock a wise selection for investors looking to take advantage of positive market trends.

You can see the full list of today's Zacks #1 Rank (Strong Buy) stocks here.

This piece was first released on Zacks Investment Research (Healthy urvival).