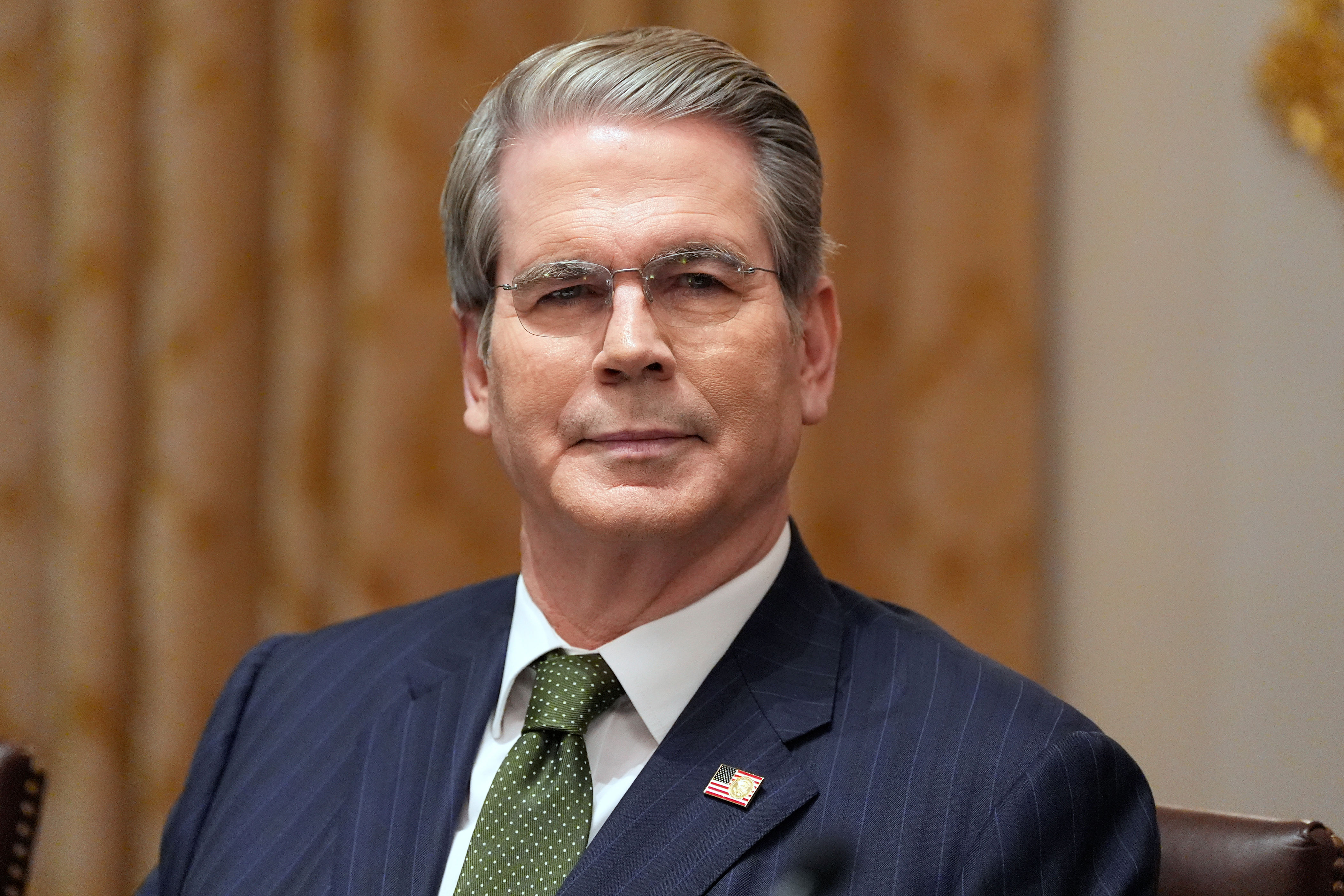

Federal Reserve official Chris Waller stated on Thursday that he supports reducing interest rates by an additional 0.25 percentage points by the end of the month, but he believes a careful approach is needed afterward.

New statements from a leading contender to succeed Fed Chair Jerome Powell in 2026 indicate that Waller might prefer keeping interest rates unchanged, aiming to observe how the economy and job market develop.

Waller observes a current tension between data indicating robust growth and a deteriorating labor market.

Something has to change — either economic growth slows down to align with a weak labor market, or the labor market improves to keep up with stronger economic growth," Waller stated in a speech in New York titled "Cutting Rates in the Face of Conflicting Data.

"Because we are uncertain about how the data will turn out in this situation, we must proceed cautiously when adjusting the policy rate to avoid making an error that would be expensive to fix," Waller stated.

Waller's words of warning follow as one of his fellow policymakers, appointed by President Trump, Fed governor Stephen Miran, urged once more on Thursday for a 50 basis point reduction in interest rates during the upcoming policy meeting on October 27-28, and noted that resurfacing trade conflicts present a threat to the economic forecast.

Miran, who is not concerned about inflation caused by tariffs, aims to reach a neutral interest rate — a rate intended to neither encourage nor hinder economic growth.

This new indication of disagreement within the Federal Reserve occurs as Waller, who had been among the Fed's most cautious voices since the summer, softens his push for rate reductions in the future.

Read more: How the Federal Reserve's interest rate decision impacts your bank accounts, loans, credit cards, and investments

It aligns with his potential appointment as the next Federal Reserve chair. Waller is currently among five candidates being evaluated by Treasury Secretary Scott Bessent, who is overseeing the selection process and will submit a final suggestion to Trump following Thanksgiving.

Markets are factoring in a rate reduction at the upcoming meeting and the December meeting as certain, but Waller's remarks also suggest that a cut in December might not be guaranteed, depending on how the data trends over the next few weeks and months.

The government shutdown is creating challenges, with Fed officials yet to receive the September employment data or retail sales figures. Inflation, as tracked by the Consumer Price Index, is also postponed until next week.

Waller is using his network to evaluate the job market and inflation. Employers have told him that there was additional easing in the labor market during the previous month, while retailers noted strong spending.

The Federal Reserve's Beige Book, which gathers informal reports from across the nation, was published on Wednesday and also presented a more pessimistic view of the employment sector.

There was limited demand for workers, with more companies indicating they had reduced their workforce via layoffs and natural turnover, citing lower demand, higher economic uncertainty, and, in certain instances, greater spending on artificial intelligence.

At the same time, the availability of workers in industries such as hospitality, agriculture, construction, and manufacturing was impacted by changes in immigration policy, leading to a reduced number of immigrants.

Read more: How employment, inflation, and the Federal Reserve are connected

With regard to inflation, Waller mentioned that "core" goods inflation is currently half a percentage point higher. Studies conducted by the Federal Reserve Board staff and other researchers suggest that much of this increase is attributed to the impact of tariffs.

He mentioned that he anticipates the impact of tariffs on inflation will diminish in the upcoming months, and that the key factor for determining interest rates is the inflation rate excluding tariffs.

Waller emphasized that his primary focus is on the job market rather than inflation, as he believes tariffs will result in sustained higher price levels, but only cause temporary inflation—a single increase in prices.

"Given that market-based indicators of long-term inflation expectations seem firmly established and a weak labor market is limiting wage pressures, I believe inflation is heading toward a consistent level of 2% and should not hinder the shift in monetary policy toward a more neutral stance," Waller stated.

Following the Fed's meeting at the end of this month, Waller mentioned that if GDP continues to grow or picks up speed and the employment sector rebounds, it could suggest that the rate of interest cuts should be slower than currently anticipated.

"I would prefer to prevent a resurgence of inflationary pressure by acting too hastily and undermining the substantial progress we've achieved in controlling inflation," he stated.

Click this link for a detailed examination of the most recent stock market news and developments influencing stock prices.

Get the most recent financial and corporate news from Yahoo Finance